pros and cons list carbon tax

Thats a long time for a scheme of taxation to go unchallenged in American politics. Advantages of Carbon Tax.

Pros And Cons Of Carbon Tax Pros An Cons

The proponents claim this would be easy to administrate as there are already special taxes in place in the energy sector that can be used as the foundation to the.

. A tax on carbon begun today must last about 40 years. At a high level the primary advantage is the carbon tax will force companies to find alternative methods in their manufacturing processes by levying a tax that increases their cost. Consumers and producers would be responsible for covering the entire social cost of consumption which has been proposed as a strategy to.

From oil companies to manufacturers everyone having a significant contribution to the increase of greenhouse gases and also pollution are subjected to carbon tax. This would result in tax revenue of 670 billion. In relation to the US Hansen argues that we could set a carbon tax at US115 per ton of CO2.

One advantage of a carbon tax would be higher emission reductions than from other policies at the same price. Contrary to that the carbon tax has a chance to incentivize emissions even lower. Carbon Tax Pros Carbon Tax Cons.

A carbon tax might lead me to insulate my home or refrain. Carbon taxes would create new tax revenues and it remains to be seen how that money would be used policymakers would decide. He suggests that this should be given 100 as a.

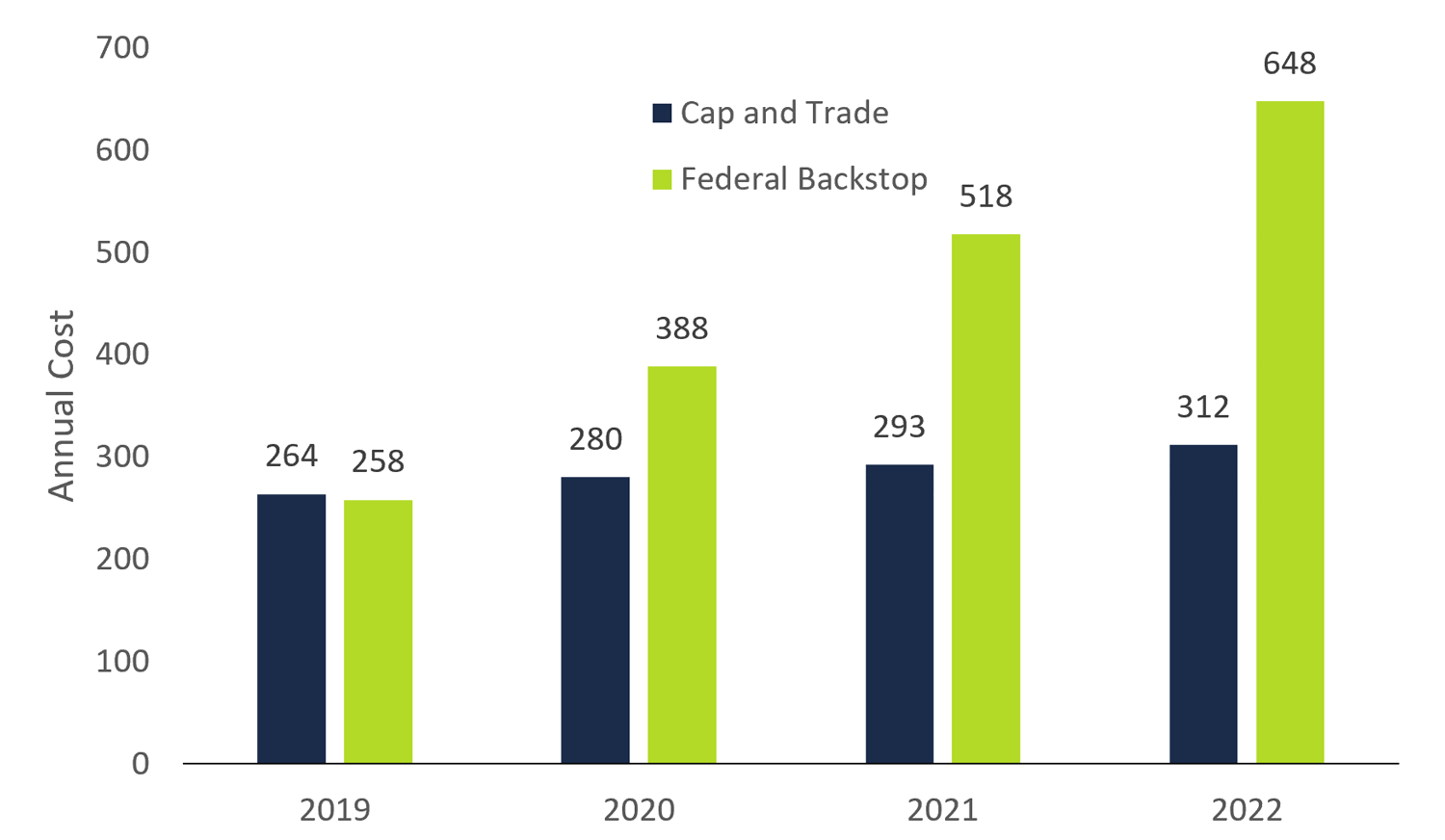

A carbon tax has a major advantage over cap-and-trade and a hybrid version because it allows for carbon price certainty is less costly to administer and is a substantial source of revenue. Companies may relocate to. The tax could be used to.

Instituting a carbon tax could help reduce the deficit and produce incremental benefits for the environment but could also raise the cost of many goods and services the. A carbon tax would hit lower-income families the hardest said CBO because low-income households generally spend a larger percentage of their income on emission-intensive. A carbon tax has a major advantage over cap-and-trade and a hybrid version because it allows for carbon price certainty is less costly to administer and is a substantial.

Since the government regulates how much emissions are allowed emissions will never rise past their cap.

World Regional Geography Unit I Introduction To World Regional Geography Lesson 4 Solutions To Global Warming Debate Ppt Download

19 Carbon Tax Pros And Cons Vittana Org

The Pros And Cons Of Buying A Mobile Home Home Nation

Pros And Cons Of Carbon Tax Pros An Cons

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Carbon Tax Or Cap And Trade David Suzuki Foundation

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

The Pros And Cons Of Carbon Offsetting Means And Matters

Pros And Cons Of Carbon Taxes Youtube

William Nordhaus Versus The United Nations On Climate Change Economics Econlib

Why Are Carbon Taxes Unfair Disentangling Public Perceptions Of Fairness Sciencedirect

8 Pros And Cons Of Carbon Tax Brandongaille Com

Carbon Co2 Emissions Tax Explained Pros Cons Alternatives

Pricing Carbon A Carbon Tax Or Cap And Trade

27 Main Pros Cons Of Carbon Taxes E C

Carbon Tax Pros And Cons Economics Help

6 Pros And Cons Of Carbon Tax Apecsec Org